42 calculating tax math worksheets

Calculating Sales Tax Ontario Worksheets & Teaching ... Math Moji Digital Calculating Sales Tax Online Game 2020 Ontario Math Curriculum. by. Dr SillyPants Classroom Resources. 3. $4.50. Zip. Google Apps™. Internet Activities. The Math Moji Digital Series is an online, interactive game series that students can play independently in the classroom or as part of at home study. › retirement-plans › self-employedSelf-Employed Individuals – Calculating Your Own Retirement ... Nov 05, 2021 · the deductible portion of your SE tax from your Form 1040 return, Schedule 1, on the line for deductible part of self-employment tax, and; the amount of your own (not your employees’) retirement plan contribution from your Form 1040 return, Schedule 1, on the line for self-employed SEP, SIMPLE, and qualified plans.

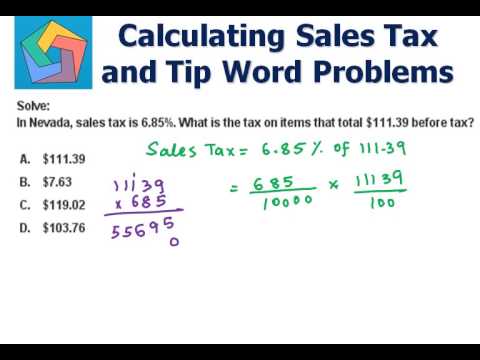

Sales Tax - FREE Math Lessons & Math Worksheets from Math ... Sales tax is a tax on goods and services purchased and is normally a certain percentage added to the buyer's cost. Solution: 2.36 ÷ $32.00 = 0.0735. Sales tax was charged by the department store at a rate of 7.375%. Answer: Mr. Smith should pay the department store $32.00 plus $2.36 in sales tax for a total bill of $34.36.

Calculating tax math worksheets

Quiz & Worksheet - Calculating Sales Tax | Study.com About This Quiz & Worksheet. In order to calculate sales tax, you need to know a specific formula. Test your knowledge of this formula and how to use it by completing the quiz and worksheet. Capital Gains Tax Calculation Worksheet - The Balance Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage. Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Free Worksheet See in a set (11) View answers Add to collection

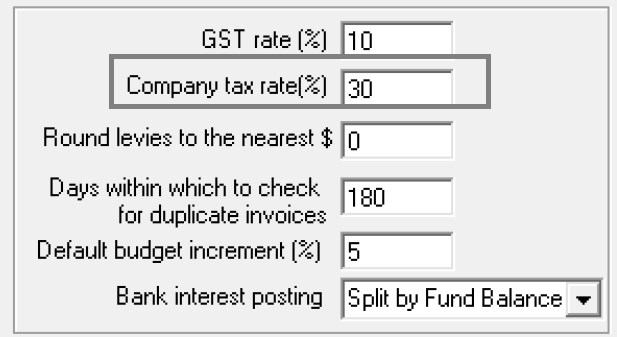

Calculating tax math worksheets. › library › learningEveryday Math Skills Workbooks series - Money Math invisible. But math is present in our world all the time – in the workplace, in our homes, and in our personal lives. You are using math every time you go to the bank, buy something on sale, calculate your wages, calculate GST or a tip. Money Math is one workbook of the Everyday Math Skills series. The other workbooks are: • Kitchen Math Quiz & Worksheet - How to Calculate Property Taxes | Study.com Worksheet 1. A house has an assessed value of $250,000. The local government has a tax rate of $75 per $1,000 for calculating the property tax. What is the property tax? $20,000 $18,750 $21,570... › node › 1576FAQs About Child Support - KLS - Kansas Legal Services These guidelines set up some math formulas for determining certain ratios and set child support based on the ages of the children and income of the parents. A Child Support Worksheet is completed to show the calculations involved and the amount of child support to be paid. You can use this program below to complete a child support worksheet for ... Sales Tax Worksheets Teaching Resources | Teachers Pay ... Sales Tax, Tip, and Discount Color-By-Number Worksheet by Eugenia's Learning Tools 13 $2.50 PDF This is a color by number worksheet focused on calculating total cost after after calculating sales tax, tip, or discount. The worksheet contains 12 problems. Answer Key provided.Great for basic independent practice or as a station activity. Subjects:

PDF Sales Tax Practice Worksheet - MATH IN DEMAND Worksheet Practice Score (__/__) Directions: Solve the following problems on sales tax. Make sure to bubble in your answers below on each page so that you can check your work. Show all of your work! 2 3 4 6 7 1If a table costs $45 and the sales tax is 5%, what is the sales tax? 0.05 Sales Tax = $2.25 taxandbusinessonline.villanova.edu › probabilityProbability, Statistics, and Data Analysis Activities for ... Extra math worksheets can also be found online and used to practice math skills at home, helping you to better understand class materials and even get a head start on upcoming assignments. Use these resources to your advantage and make sure to get the help of a parent or teacher if you’re struggling with probability, statistics, or data ... Calculating Tax Worksheet Teaching Resources | Teachers ... This resource is great for students who need practice calculating tax, gratuity and discounts from word problems. Problems include scenarios where students are given a total amount of a bill, tax and gratuity percent, and students need to calculate the final amount. Students should know which to calculate first, second, and so on… Money Worksheets With Tax | Teachers Pay Teachers Worksheets and Task Cards Add Subtract Next Dollar Up and Calculate Sales Tax by Carol Bell - Saved By A Bell 19 $27.25 $21.75 Bundle Zip SHOPPING MADE FUN and EASY! This product simulates a real shopping experience for kids who are working on functional math skills using super engaging TASK CARDS and NO PREP!

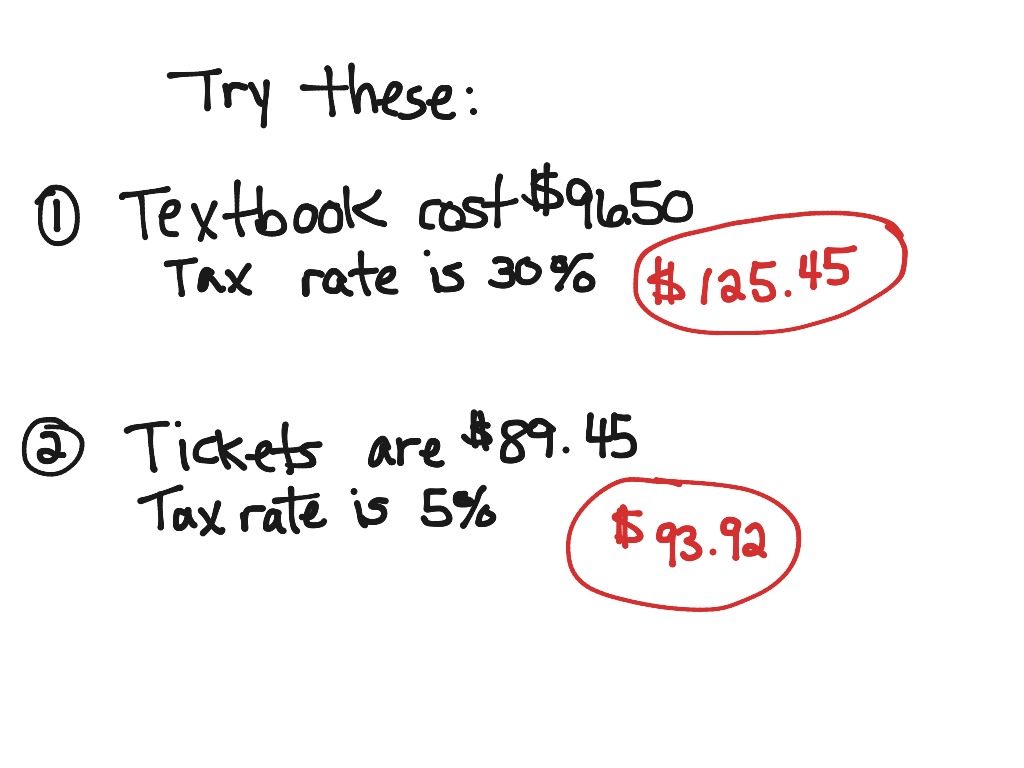

Taxes Lesson Plans, Income Tax Worksheets, Teaching Activities A basic worksheet to help teach young students the concept of paying taxes while practicing basic math. SALES TAX Discount and Sales Tax Lesson Plan Students learn about sales tax and discounts. Lesson includes changing percents and calculating total cost. Includes a teaching lesson plan, lesson, and worksheet. Sales Tax Introduction (Level 1) Adding Taxes Using Percentages - WorksheetWorks.com WorksheetWorks.com is an online resource used every day by thousands of teachers, students and parents. We hope that you find exactly what you need for your home or classroom! Quiz & Worksheet - Calculating Taxes & Discounts | Study.com Worksheet 1. Mary buys a pair of jeans for $24.99, a skirt for $32.99 and a pair of shoes for $49.99. She has a coupon for 15% off the most expensive item. If the tax is 7.5%, what is the total... PDF Sales Tax and Discount Worksheet Tax: A tax on sales that is paid to the retailer. You need to add the sales tax to the price of the item to find the total amount paid for the item. Procedure: 1.The rate is usually given as a percent. 2.To find the tax, multiply the rate (as a decimal) by the original price. 3.To find the total cost, add the tax to the original price.

Percents Worksheets - Math-Drills This page includes Percents worksheets including calculating percentages of a number, percentage rates, and original amounts and percentage increase and decrease worksheets. As you probably know, percents are a special kind of decimal. Most calculations involving percentages involve using the percent in its decimal form.

PDF Lesson 3 v2 - TreasuryDirect tax. 6. calculate tax rates (percents) and the dollar amount of taxes. 7. read and understand tax tables. Mathematics Concepts computation and application of percents and decimals, using and applying data in tables, reasoning and problem solving with multi-step problems Personal Finance Concepts income, saving, taxes, gross income, net income ...

Income Tax worksheet ID: 1342388 Language: English School subject: Math Grade/level: Secondary Age: 11-18 Main content: Income Tax Other contents: Percentages Add to my workbooks (5) Download file pdf Embed in my website or blog Add to Google Classroom

How to calculate taxes and discounts | Basic Concept ... There are two types of taxes: direct tax and indirect tax. In this lesson, we will study the tax computation when the selling price or price before tax is given. We calculate tax on a product by multiplying the tax rate with the product's net selling price. Tax amount = \($(S.P. \times \dfrac{Tax\ rate}{100})\)

PDF Worksheet: Calculating Marginal vs. Average Taxes ... Worksheet: Calculating Marginal vs. Average Taxes Worksheet, with answers (Teacher Copy) Federal Tax Brackets and Rates in 2011 for Single Persons From: To: Taxed at Marginal Rate of: $0 $8,500 10% $8,501 $34,500 15% $34,501 $83,600 25% $83,601 $174,400 28% $174,401 $379,150 33% $379,151+ 35%

Income Tax Worksheets Teaching ... - Teachers Pay Teachers Taxes: Gross & Net Income Budget Calculation Worksheet by Elena Teixeira $1.75 Word Document File This worksheet will take your students through a step-by-step simulation of calculating their net income from a gross income starting point.

Calculate Sales Tax | Worksheet | Education.com Entire Library Worksheets Fourth Grade Math Calculate Sales Tax. Worksheet Calculate Sales Tax. It would be great if we never had to learn about sales tax, but since we do, 4th grade is as good a time as any! Throw in some favorite baseball game snacks for fun and get cracking. Add the sales tax and find how much each person's meal will cost.

PDF Discount, Tax and Tip - Effortless Math Math Worksheets Name: _____ Date: _____ … So Much More Online! Please visit: EffortlessMath.com Discount, Tax and Tip Find the selling price of each item.

Finding the rate of a tax or commission: Worksheets Finding the rate of a tax or commission: Worksheets. Welcome to the Finding Percents and Percent Equations Worksheets section at Tutorialspoint.com. On this page, you will find worksheets on finding a percentage of a whole number, finding a percentage of a whole number without a calculator: basic & advanced, applying the percent equation ...

› resources › lessonsAlgebra Help - Calculators, Lessons, and Worksheets - Wyzant ... Need to practice a new type of problem? We have tons of problems in the Worksheets section. You can compare your answers against the answer key and even see step-by-step solutions for each problem. Browse the list of worksheets to get started… Still need help after using our algebra resources? Connect with algebra tutors and math tutors ...

Calculating Total Cost after Sales Tax worksheet Close. Live worksheets > English > Math > Percentage > Calculating Total Cost after Sales Tax. Calculating Total Cost after Sales Tax. Finding Sales Tax and Total Cost after it is applied. ID: 839531. Language: English. School subject: Math. Grade/level: Grade 5. Age: 7-15.

How Your Tax Is Calculated: Tax Table and Tax Computation ... In those instructions, there are two worksheets which together calculate your tax. First, there is a 25-line worksheet called the Qualified Dividends and Capital Gain Tax Worksheet, which separates your total qualified income (line 4) from your total ordinary income (line 5), so they can be taxed at their different rates.

› worksheets › enPercentage worksheets and online exercises Percentage worksheets and online activities. Free interactive exercises to practice online or download as pdf to print.

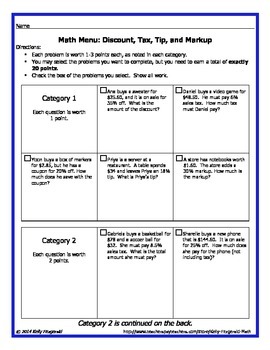

Markup, discount, and tax - FREE Math Worksheets A lot of "real-life" math deals with percents and money. You will need to know how to figure out the price of something in a store after a discount. You will also need to know how to add tax to your items to make sure you brought enough money! If

Applying Taxes and Discounts Using ... - WorksheetWorks.com Create a worksheet: Find the price of an item after tax and discount. Applying Taxes and Discounts Using Percentages. Find the price of an item after tax and discount. These problems ask students to find the final price of various items after discounts and taxes are applied. ...

How to Find Discount, Tax, and Tip? (+FREE Worksheet!) Download Discount, Tax and Tip Worksheet Answers \(\color{blue}{$220.00}\) \(\color{blue}{$420.00}\) \(\color{blue}{$540.00}\) \(\color{blue}{$275.00}\) ) Reza. Reza is an experienced Math instructor and a test-prep expert who has been tutoring students since 2008. He has helped many students raise their standardized test scores--and attend the ...

Calculating Sales Tax | Worksheet | Education.com Catered to fifth-grade students, this math worksheet shows kids the steps to find the amount something costs with tax. This process uses decimal numbers, rounding, and division. Students practice what they learn in both straightforward calculations and in word problems. Download Free Worksheet See in a set (11) View answers Add to collection

Capital Gains Tax Calculation Worksheet - The Balance Short-term gains are taxed according to your tax bracket for your ordinary income. You can offset capital gains with capital losses, which can provide another nice tax break, although certain rules apply. Preparing and using a worksheet to calculate your gains and losses can help you identify them at tax time and use them to your best advantage.

0 Response to "42 calculating tax math worksheets"

Post a Comment